The Debt Snowball Method is a debt repayment strategy that focuses on paying off debts from the smallest balance to largest balance. You pay off the smallest debts then work your way up the list through to the largest debts.

Here is how it works:

1. List Your Debts:

- Make a list of all your debts, including credit cards, loans, and all other outstanding balances.

- Arrange them in ascending order based on the current balance (from smallest to largest).

2. Minimum Payments:

- Continue making the minimum payments on all the debts to avoid late fees and penalties.

3. Extra Payments:

- Allocate any extra funds you have toward the debt with the smallest balance.

- Pay as much as you can afford beyond the minimum payment for that specific debt.

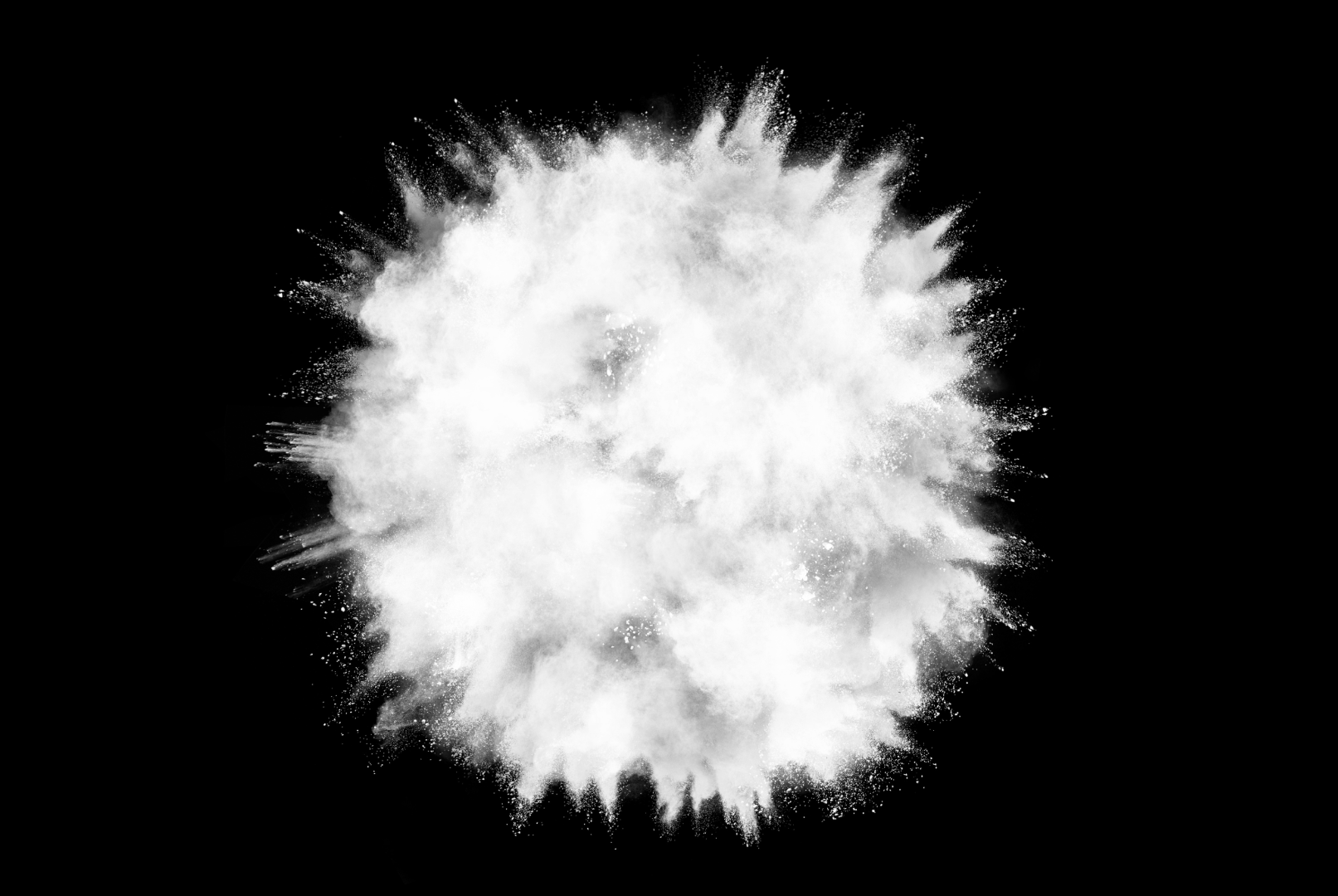

4. Snowball Effect:

- As you pay off the smallest debt, celebrate your progress!

- Once the smallest debt is paid off, take the entire payment amount (including the minimum payment), and apply it to the next smallest debt.

- This creates a snowball effect, where the debt payments gain momentum.

5. Repeat:

- Keep repeating this process until all debts are paid off.

- Each time you pay off a debt, roll that payment into the next one on your list.

Benefits of the Debt Snowball Method:

- Psychological Boost: By paying off the smaller debts, it quickly provides a sense of accomplishment and motivation.

- Simplicity: It is straightforward and easy to follow.

- Behavioural Change: By focusing on small wins, you build positive financial habits. Ultimately it feels great to pay off debt.

It is important to remember, that while the Debt Snowball Method may not be the most mathematically efficient, it can be highly effective for those who need the psychological boost to stay motivated.

Choose the method that aligns best with your financial goals.

By paying off debt you are taking control of your financial future.